Description: Review the state tax configurations that are out of the ordinary for the Hospitality software. This is not an all-inclusive list.

Important: Shift4 is not responsible for maintaining your State, Local, or Federal Taxes. You are ALWAYS held accountable for your Tax Settings and should be aware of any tax changes that may affect your business.

For more information on creating or editing taxes, visit the Add or Edit Taxes article.

Ohio State Sales Tax Setup

The state of Ohio has a unique tax setup with the following rules:

- All Dine-in food is always taxed

- Takeout food is never taxed

- Beverages are always taxed regardless of Dine-in or Takeout status

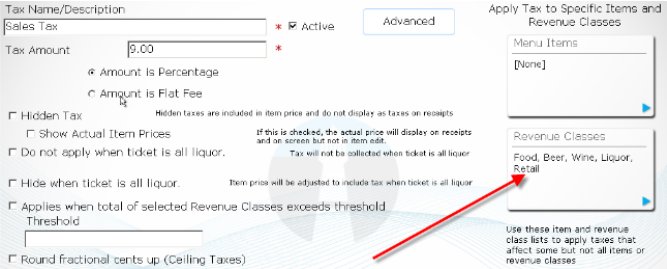

For the Food Tax

Build the tax normally, but do NOT add beverages to the revenue class.

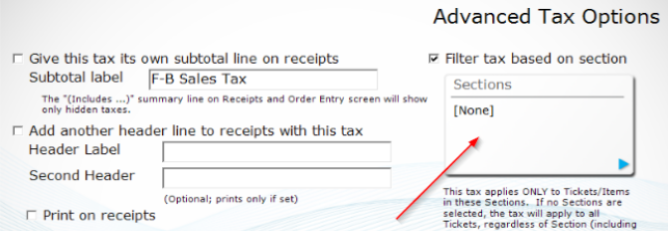

- Then, select Advanced.

- Place a check in the box next to Filter tax based on section and select the box to attach the Dine In section to the tax ONLY.

- Select OK to commit.

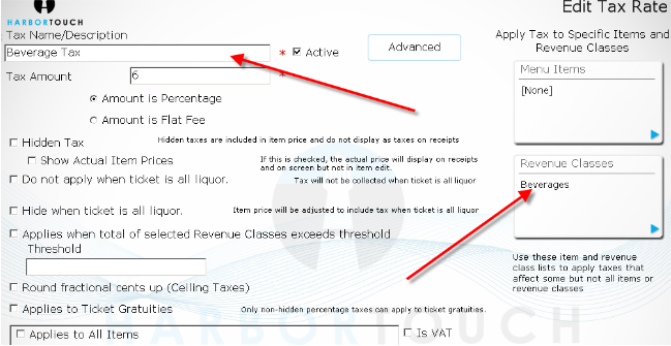

For the Beverage Tax

Create a separate Beverages Tax and apply it ONLY to the Beverages revenue class.

Comments

0 comments

Please sign in to leave a comment.